Life Insurance

Home – Insurances

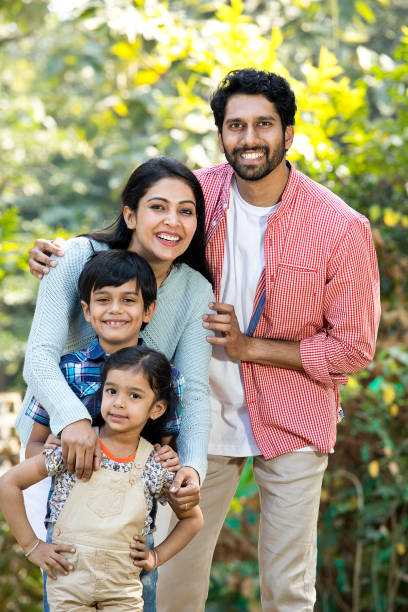

Secure your loved ones' future with our life insurance.

Life insurance provides essential financial protection for your loved ones in the event of your death. By securing a life insurance policy, you ensure that your family can maintain their standard of living and cover important expenses, such as mortgage payments, education costs, and daily living expenses, even after you’re gone.

Protect Your Life & Save up to 35%

Ensure your family’s financial security while keeping more money in your pocket. Get a quote today and start saving!

Peace of Mind

Experience true peace of mind, knowing that your future is secure with our reliable insurance solutions

Set For Life

Life's uncertainties are no match for those who plan ahead. Secure your future, set for life.

Tailored Cover

Get the coverage you need, exactly the way you want it. Our tailored insurance plans are crafted to suit your individual requirements.

Life insurance isn’t just about planning for the inevitable; it’s about cherishing the precious moments of today while securing the promise of tomorrow. It’s a pledge to protect what matters most, ensuring that your family’s journey continues uninterrupted, no matter what life may bring.

FAQs

Expert Answers to Your Insurance Queries

Insurance company FAQs address common inquiries about coverage, claims, premiums, and policy details for customer clarity.

Life insurance provides financial protection for your loved ones in the event of your death. It can help cover funeral expenses, outstanding debts, mortgage payments, and provide income replacement for your family.

The amount of life insurance coverage you need depends on various factors, including your age, income, debts, lifestyle, and the financial needs of your dependents. A general rule of thumb is to have coverage that is 5 to 10 times your annual income.

Yes, you can typically make changes to your life insurance policy, such as increasing or decreasing coverage, changing beneficiaries, or converting a term policy to a permanent policy. However, some changes may require approval from the insurance company.

Generally, life insurance benefits paid to the beneficiary are not taxable as income. However, there are exceptions, such as if the policyholder has borrowed against the cash value of a permanent life insurance policy.

The best time to buy life insurance is when you’re young and healthy, as premiums tend to be lower. However, it’s never too late to get coverage, and it’s essential to have life insurance in place to protect your loved ones regardless of your age.

Excellence for 14 years strong.

Since 2010, our insurance company has safeguarded dreams. We’ve weathered storms, rebuilt lives, and protected legacies.

Get a Quote!

Services

Commitment to customers, decade after decade.

Since 2010, our insurance company has safeguarded dreams. We’ve weathered storms, rebuilt lives, and protected legacies. Empowering generations, our unwavering commitment stands strong. Trust us to shield your future’s chapters.

Policy Coverage Evaluation

You have the appropriate level of protection for your needs. This involves assessing risks, determining coverage limits, etc.

Claims Processing

Efficient and fair claims processing. This involves assisting you in filing claims, conducting investigations when necessary, etc.

Risk Management Assistance

We offer risk management guidance to help you to identify potential risks and implement strategies to minimized.

Policy Customization

We offer customizable coverage solutions, allowing you to select appropriate coverage levels, deductibles, and additional endorsements.

Insurance Education and Advice

We educate and inform you about insurance-related matters. We offering resources, articles, and others.

Premium Payment Options

We Offer you to make online payment portals, automatic payment plans, or alternative payment methods.

Customer Support

Timely and knowledgeable assistance should be available through various channels, including phone, email, and online chat.

Loss Prevention Services

We offer loss prevention services to help you minimize potential risks. This can involve conducting inspections, etc.,

Reliability and Trust in Insurance Solutions